Savings Account

Unlock the power of your money with UNO Bank’s high-interest savings accounts in the Philippines, designed to help you grow your wealth effortlessly. With daily interest, your savings earn more every day, rather than accumulating monthly or yearly. This means the interest you earn compounds quickly, giving you a greater return on your deposit over time.

Experience the convenience and rewards of banking digitally, and watch your savings grow faster with each passing day.

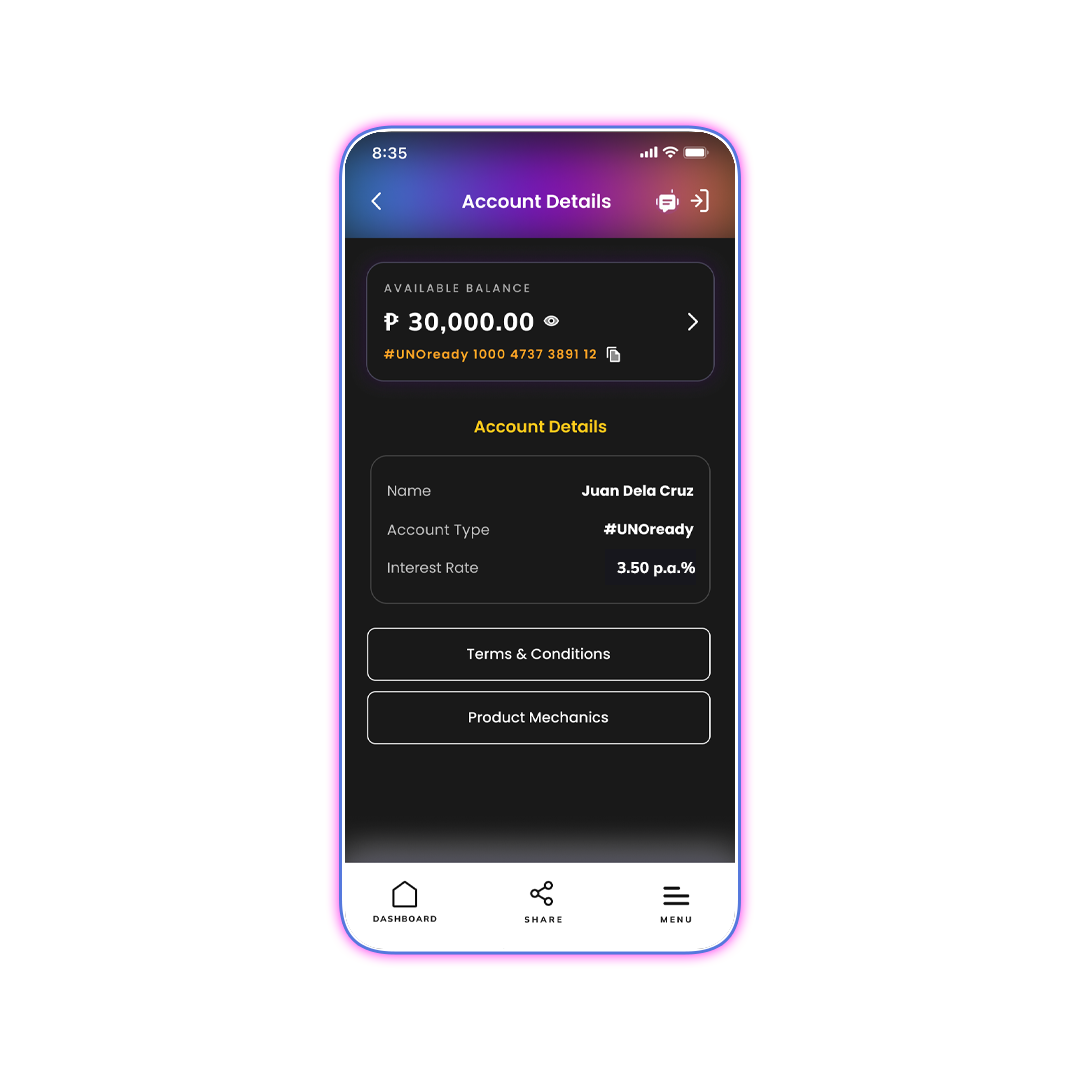

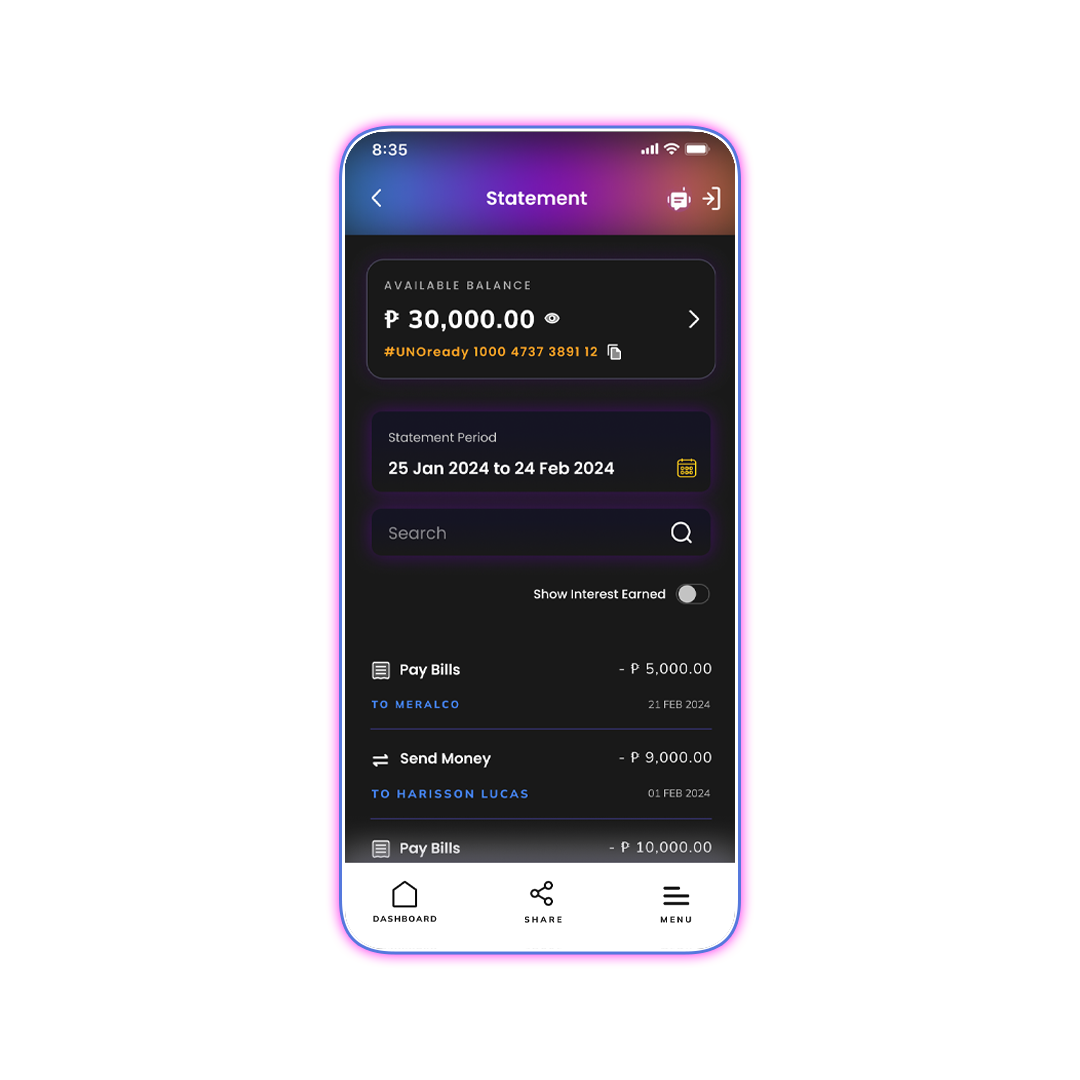

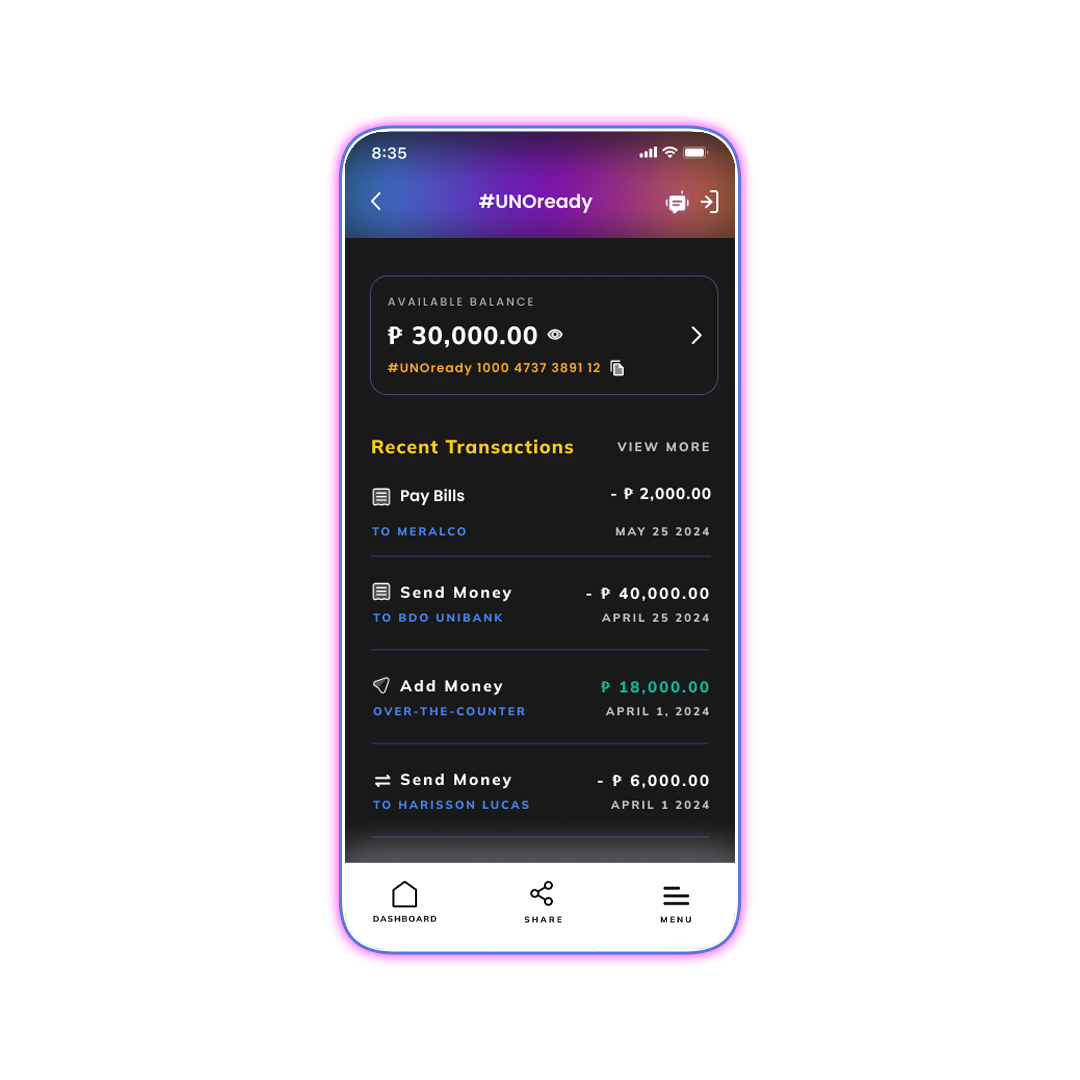

#UNOready Savings Account

Now you’re ready for anything with your savings account at UNO. Send money, pay bills, and shop online while your money grows!

- Be ready to elevate your earnings with as much as 3.50% p.a. interest credited DAILY!

- Easy funding through InstaPay and PESOnet.

- Get free Personal Accident Insurance coverage worth PHP 100,000.00.

- Get a FREE virtual card when you deposit at least PHP 100.00.

Earn up to 3.50% interest

Be #UNOready! Elevate your savings with an interest rate of up to 3.50% for deposits PHP 5,000.00 and up, and 3.00% for below PHP 5,000.00

The Smart Way to Save: High-Interest Savings Account in the Philippines

With UNO Digital Bank, you get a high-interest savings account that helps your money grow faster while keeping banking simple and seamless. Enjoy the convenience of managing your savings, transfers, and payments—all in one secure, fully digital app.

No Fees

Cash in free at 7,500+ outlets, cash out at 4,500+, and enjoy daily interest crediting. Send or receive money via QR for free on P2M transactions. P2P transfers via InstaPay now come with a fee.

Personal Accident Insurance

Get free ₱100,000 Personal Accident Insurance when you maintain a ₱10,000 average daily balance—valid until you turn 66.

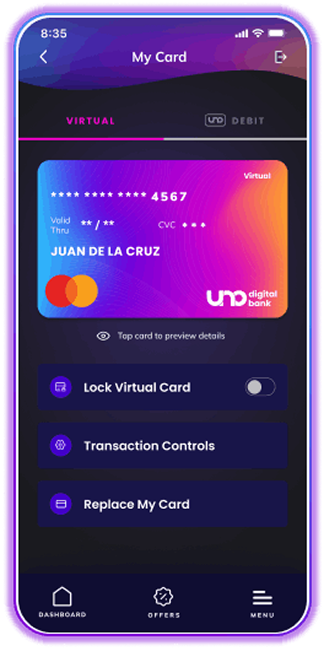

Debit Card

Get a free UNO Virtual Debit Mastercard with just a ₱100 deposit for secure online shopping anywhere Mastercard is accepted, locally and globally.

A physical debit card is also available upon request.

Maximize Your Savings with UNO

Enjoy quick, convenient, and secure payments with the UNO Debit Mastercard virtual and physical cards—perfect for managing your high-interest savings account in the Philippines!

How to Receive a Virtual Card

Get a FREE virtual UNO Debit Mastercard in 3 easy steps:

- Deposit at least PHP 100.00 to your #UNOready account

- Access “My Card”

- Activate your Virtual Card

UNO Debit Mastercard

One of the first numberless card in the Philippines!

Your card details are stored inside the chip and

are not visible on the card, making any lost or

stolen card unusable.

Account Features: How It Works

Enjoy secured banking, easy access to your funds, and an elevated shopping experience with the UNO Debit Mastercard, all while maximizing the benefits of a high-interest savings account in the Philippines and earning exciting rewards.

Safe & Secure

Access your UNO Virtual Debit Mastercard with a personal PIN and an OTP (One-Time Password) for complete peace of mind.

Global Acceptance

Our UNO Debit Mastercard can be used virtually and physically at all Mastercard-accepting merchants worldwide.

Sustainable

Our cards are made up of 85.50% recycled plastic, reducing waste and environmental impact with every swipe.

Save More with a High-Interest Savings Account

Saving is easier and more rewarding with UNO’s high-interest savings account in the Philippines. With great rates, your money grows faster—helping you secure your future without the hassle.

Boost Your Earnings with Competitive Interest Rates

With interest rates of up to 3.50%, your savings have the potential to grow significantly over time. By offering daily interest crediting, your money earns interest every single day, helping it grow even faster compared to monthly or yearly credited accounts.

Grow Your Savings on Your

Terms

Manage your high-interest savings account in the Philippines on the go through our fully digital app—no branches needed, just pure convenience. With the app, you can check your balance, track your earnings, and make transfers in just a few taps.

Access Your Account Anytime, from Anywhere

Manage your savings account on the go through our fully digital app. With features like real-time updates, instant transfers, and 24/7 access, you can stay in control of your finances whenever and wherever it’s most convenient for you.

Unlock Extra Rewards with Exclusive Savings Rates

Enjoy exclusive rates: 3.00% for balances between PHP 0.01 and PHP 4,999.99, 3.50% for balances between PHP 5,000 and 4.99M, and 1.00% for balances over PHP 5,000,000. Your interest is credited daily.

Requirements to Sign Up for Our High-Savings Account in the Philippines

Signing up for our high-interest savings account is quick and easy. Just provide a valid ID, and you’ll be all set to enjoy great rates and secure banking.

Eligibility Criteria:

- A resident citizen of the Philippines

- At least 18 years old

- Have a present/permanent address in the Philippines

- One (1) valid government-issued ID

- A valid email address

- A local Philippine mobile number

- Not subject to the Foreign Account Tax Compliance Act (FATCA)

Start Saving in 3 Easy Steps

Getting started with a high-interest savings account in the Philippines is simple and hassle-free. Just follow these quick steps, and you’ll be on your way to growing your savings with ease.

- Download and install the UNO Mobile App

- Have your valid ID ready

- Complete the easy onboarding process

Frequently Asked Questions About Our High-Interest Savings Accounts in the Philippines

#UNOready is a HIGH-RATE savings account with tiered interest(1) rates. It comes with a Mastercard debit card to offer an easy and convenient way to make purchases and manage banking transactions. UNO Savings Account also comes with FREE life insurance with PHP 50,000.00 coverage.

It only takes a few minutes to open an account through the UNO Digital Bank mobile application. There is no initial deposit and no maintaining balance required to keep the account.

(1)Interest earnings from this account are subject to government taxes and may be changed without prior notice.

(2)Minimum deposit of PHP 100.00 is required to activate the FREE virtual card.

(3)Minimum average daily balance of PHP 10,000.00 is required to qualify. Age eligibility is between 18 and 65 years old, in good health, not in military, naval or air service or engaged in hazardous activities. Insurance provided by Sunlife Grepa Financial.

A base interest rate of 3.00% gross per annum applies to accounts with available end of day balance below PHP 5,000.00 while a step-up interest rate of 3.50% gross per annum applies to accounts with an available end of day balance from PHP 5,000.00 to PHP 4,999,999.99. 1.00% gross per annum interest rate will be applied once the available end of day balance reaches PHP 5,000,000.00 or higher. Interest earned is credited to the account daily.

| End of Day Balance | Gross Interest Rate | |

|---|---|---|

| From | To | |

| PHP 0.01 | PHP 4,999.99 | 3.00% |

| PHP 5,000.00 | PHP 4,999,999.99 | 3.50% |

| PHP 5,000,000.00 | Above PHP 5M | 1.00% |

Gross interest rate is applied to the total end of day balance.

You can compute for your interest earned for the day using the formula below:

Gross Interest Earned = Principal * Interest Rate * (1/number of days in a year).

For example, at the end of the day you have PHP 55.00 in your account. It means that gross interest earned is PHP 0.01 = 55*3.00%*(1/365).

The minimum interest that gets credited to your account is PHP 0.01.

Interest earnings from this account are subject to government taxes and may be changed without prior notice.

*365 or 366 depending on the actual number of days in a year

– Individuals 18 Years of Age or Older

– Filipino Citizens

– Must have an active mobile number registered in the Philippines

– Must have a valid Philippine Mailing -Address

– Must have at least one (1) valid Philippine ID: (any ID listed below)

- PhilSys ID

- ePhilID

- UMID

- Passport

- Driver’s License

- PRC ID

- SSS ID

- PhilHealth ID

Add Money In-App and Over-the-Counter is temporarily unavailable as we make way for an upgrade to serve you better.

In the meantime, you can still transfer funds to your #UNOready savings account via QRPH scan, InstaPay, or PESONet from your other e-wallets or bank accounts.

| Transaction | Fee |

|---|---|

| Virtual Debit Card Issuance Fee | Free upon account activation |

| Virtual Debit Card Replacement Fee | PHP 50.00 |

| Physical Debit Card Issuance Fee | PHP 300.00 |

| Physical Debit Card Replacement Fee | PHP 300.00 |

| Local Transactions | |

| Balance Inquiry | For Mastercard Preferred Bank/Other Bank: PHP 0.5 + Acquirer Fee |

| ATM Withdrawal | For Mastercard Preferred Bank: PHP 18.00 For Other Bank: As charged by ATM provider |

| International Transactions | |

| International Transaction Service Fee | 2.50% of Transaction Amount |

| Balance Inquiry | PHP 50.00 |

| ATM Withdrawal | PHP 200.00 |

Your All-in-One App for High-Interest Savings in the Philippines

UNO is your go-to digital bank for managing your high-interest savings account in the Philippines. With our intuitive mobile app, you can easily access your savings, transfer funds, and track your balance—anytime, anywhere.

Plus, with the UNO Virtual Debit Mastercard, you can make secure online purchases locally and internationally, wherever Mastercard is accepted. As a fully digital bank, UNO offers efficient and secure banking, fully regulated by the Bangko Sentral ng Pilipinas and insured by the Philippine Deposit Insurance Corp.

PDIC-insured

Deposits are insured by the Philippine Deposit Insurance Corporation (PDIC) up to P1 Million per depositor