Loans

Looking for a quick and hassle-free way to get the funds you need? With an online bank loan in the Philippines from UNO Digital Bank, you can access fast, convenient loans right from your phone, with no paperwork, and no stress.

#UNOnow Online Bank Loan

For when you need cash now. There’s no need to worry about unexpected financial needs.

- No collateral, no guarantors needed

- Get loanable amounts up to PHP 250,000.00

- With monthly add-on rates as low as 1.79%

Why Choose UNO for Your Loan?

With UNO Digital Bank, accessing an online bank loan in the Philippines is fast, easy, and entirely digital—no branches needed. Access the funds you need through a straightforward and efficient process designed to fit your lifestyle. While approval times may vary, rest assured that we work to ensure a smooth experience every step of the way.

Quick Loan

Approval

We make loan approval quick and hassle-free—no guarantors or complicated paperwork required. Just submit your requirements, and once approved, you’ll receive an email with your loan details and contract. You don’t need an existing bank account or credit card from another bank.

Online

Application

Just download the UNO Mobile App, complete the Selfie Check, and fill in your details. Once approved, you’ll see its status when you enter the UNO Mobile App. You will also be notified via SMS.

Easy

Requirements

If you’re a Filipino citizen, between 21 and 65 years old at loan maturity, and earning at least PHP 20,000 a month, you’re eligible. Whether you’re employed or self-employed, applying for a loan is quick and hassle-free.

Loan Requirements

Applying for your #UNOnow is easy! To get started, just prepare

these three (3) simple requirements:

Contact Details

Input your active mobile number and email address to start your application

and to serve as our means to contact you.

Valid ID

One (1) valid ID is enough! Scan any ID you have. Remember, it must include the following details: ID number, gender, and civil status.

A Selfie

Part of the eKYC process is to ensure that the account is protected and the applicant exists. As proof of life, take a selfie, and you’re good to go!

Your Loans Journey

Apply for a loan and get it #UNOnow with our quick and easy process!

Step 1: Product Selection

Select the loan product you want to apply for. Enter your mobile number and validate it using the One-Time Password (OTP) provided.

Step 2: Consent & User Verification

Read the terms & conditions carefully. Accept once understood and if you agree. For identity verification, provide a valid ID, a selfie, and a liveness check via ZOLOZ’s Deep Scan.

Step 3: Initial Profile Assessment

Kindly wait as UNO Digital Bank further examines and evaluates your information in our database.

Step 4: Profile Completion & Declaration

Provide your personal, employment, and financial information necessary for further checking. Then, answer the FATCA and DOSRI questionnaires.

Step 5: Approval & Registration

Review the approved loan terms and select if you wish to proceed. If yes, register and set a password and passcode. Upon availing, proceeds will automatically be credited to your UNO Savings Account.

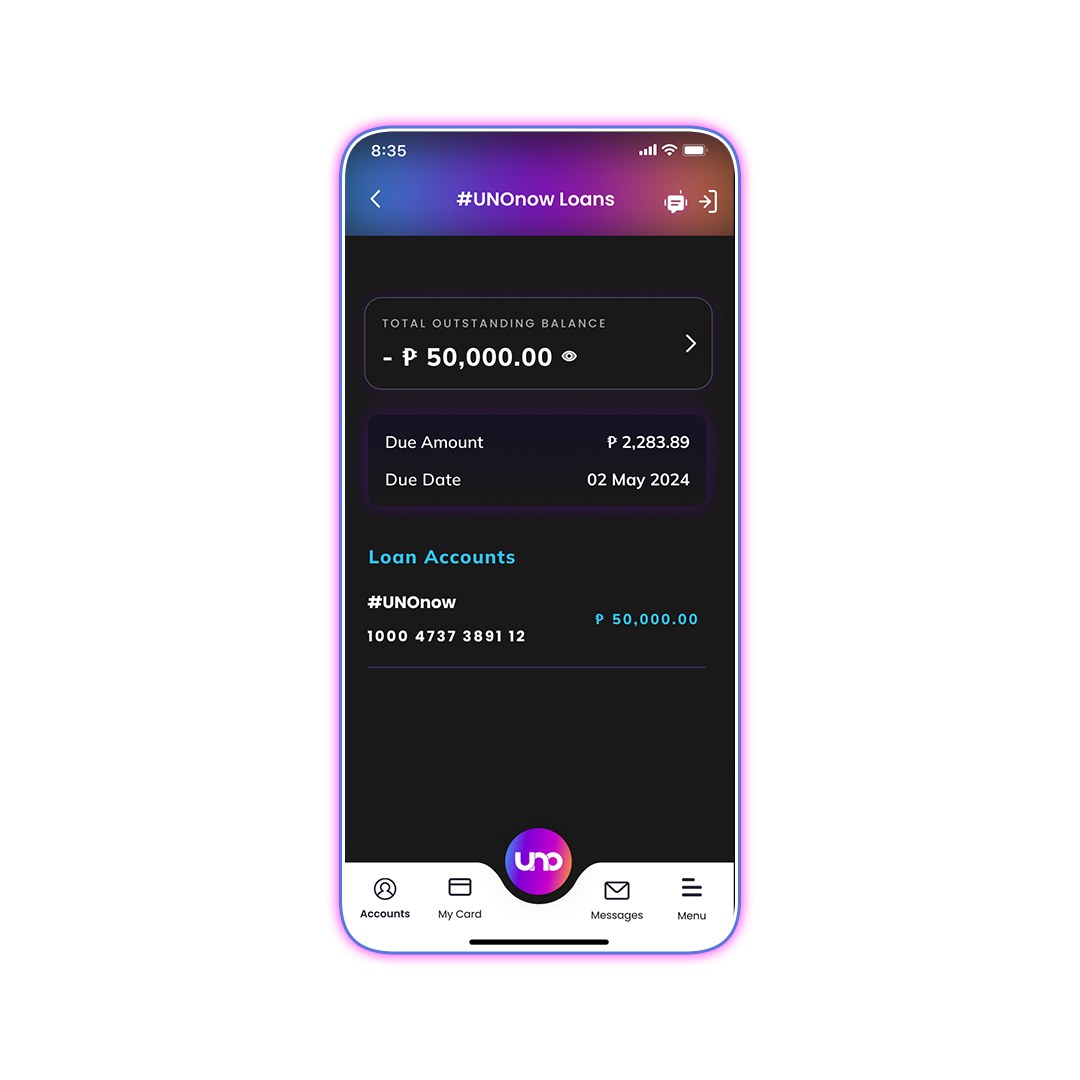

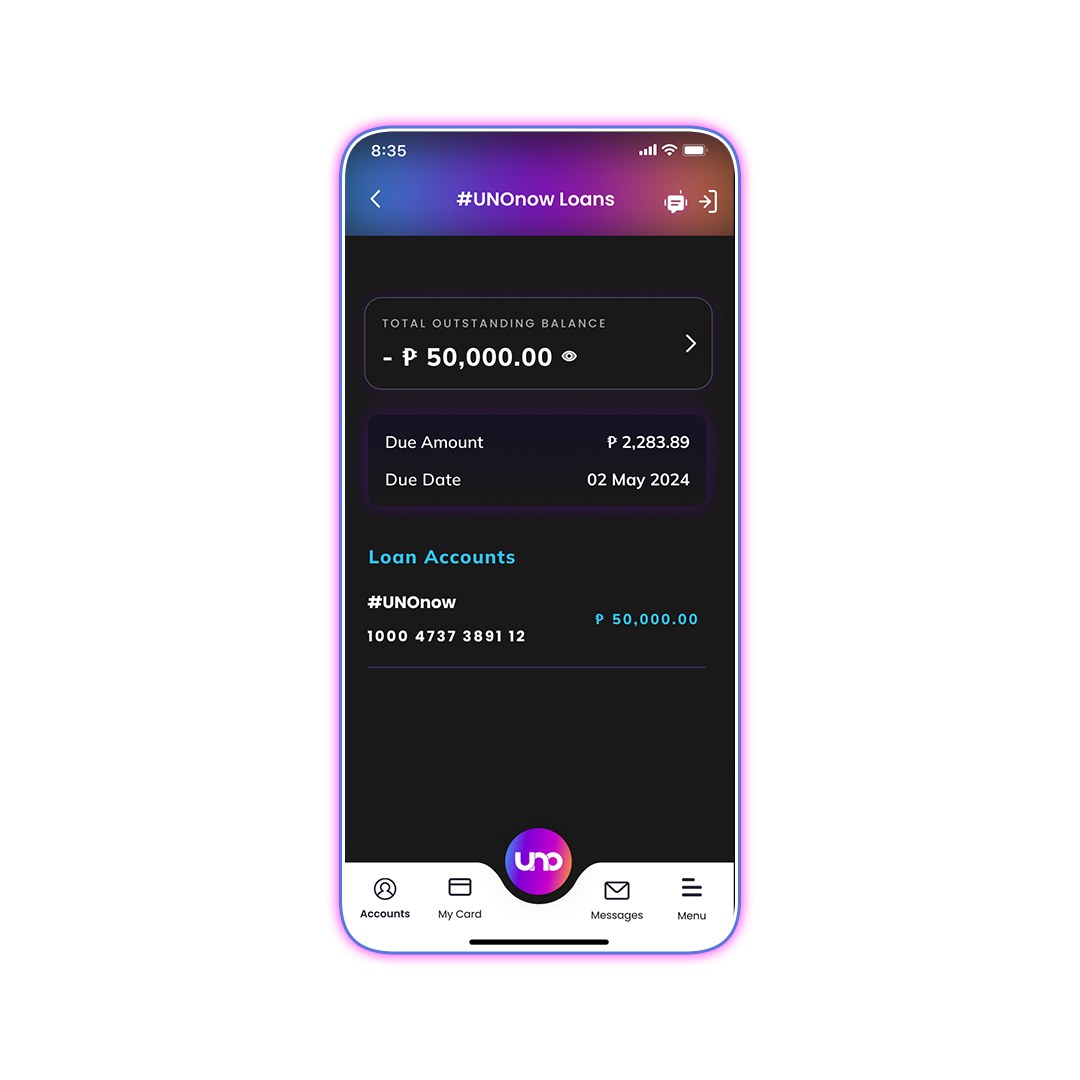

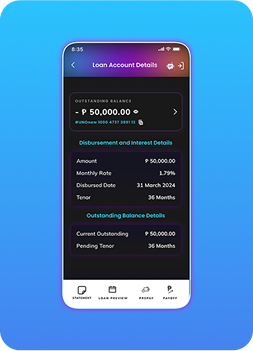

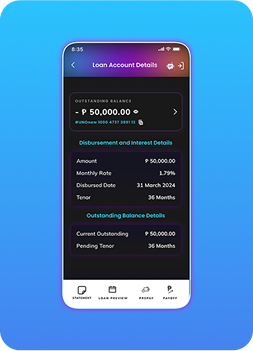

Payback Easily Through the App

Paying back your online bank loan in the Philippines is effortless with the UNO app, giving you the flexibility to make payments anytime,

anywhere. Here’s how:

Tap “Pay Now” under the LOANS section.

Enter the payment amount and select Continue.

Review the payment details, then tap Pay to proceed.

View your receipt or tap Done to return to the homepage.

How UNO's Online Bank Loan Can Help You

UNO Digital Bank’s online bank loan in the Philippines makes it easy to meet your financial needs quickly and conveniently. Whether you’re covering tuition fees, funding a business, or handling unexpected expenses, UNO provides a simple, flexible solution.

Pay for Tuition Fees

Get the funds you need for your child’s tuition and focus on their education, leaving financial stress behind.

Fund Your Small Business

Part of the eKYC process is to ensure that the account is protected and the applicant exists. As proof of life, take a selfie, and you’re good to go!

Handle Unexpected Expenses

Access funds quickly for emergencies, ensuring you stay financially secure when life throws you a curveball.

Invest in Your Future

Use your UNO loan to invest in your personal growth—whether for education, business, or a passion project.

Truth in Lending Act

UNObank, Inc. is committed to upholding the principles of the Truth in Lending Act. You can access the complete details of the RA 3765 by reading it in full below.

PDIC-insured

Deposits are insured by the Philippine Deposit Insurance Corporation (PDIC) up to P1 million per depositor

Frequently Asked Questions

- Individuals

- At least 21 years old; must not be older than 65 years old upon loan maturity

- Filipino national/resident

- Resides and/or works in any of our accepted locations. Click here to view the full list.

- Receives a minimum gross monthly income of PHP 20,000

- If employed, must be tenured for at least 6 months

- If self-employed, business must be in operations for at least 2 years

Bank account or credit card are not required to apply for an UNO Loan. However, having a credit card may increase your chances of approval.

- Open the UNO Mobile App

- Tap JOIN UNO on the login page

- Provide a valid PH mobile number and email address and verify the mobile number via One Time Pin (OTP)

- Select #UNOnow in the product selection screen

- Capture a valid government issued ID

- Philsys National ID

- ePhilID

- Philippines Passport

- Driver’s License

- Unified Multi-Purpose ID (UMID)

- Social Security System (SSS) ID

- Professional Regulation Commission (PRC) ID

- Perform the Selfie Check steps and provide your personal information

- Review your loan application and submit it for credit evaluation

- Once submitted, your application will be reviewed and processed. Your application will be endorsed to a third-party service provider for residence verification.

- If approved, you will be asked to either accept or decline the loan offer. Once accepted, the loan proceeds will be available for drawdown and an email with the loan contract and details will be sent to you.

- Disbursed loan amount can be withdrawn via Send Money in the UNO mobile application

If you are an existing customer of UNO (which means you already have an #UNOready Savings Account), you can apply for a loan by following below steps:

- Log in to the UNO Mobile App

- Go to the Loans Dashboard

- Tap Apply

- Provide additional information

- Review your loan application and submit for evaluation by tapping the Confirm button in the Summary Screen

- Once submitted, your application will be reviewed and processed. Your application will be endorsed to a third-party service provider for residence verification.

- If approved, you will be asked to either accept or decline the loan offer. Once accepted, the loan proceeds will be available for drawdown and an email with loan contract and details will be sent to you.

Employed Requirements:

- Valid ID (for identity verification), AND

- ANY of the following:

- Latest one-month pay slip

- Certificate of Employment (COE) with Conpensation

- Credit Card Statement of Account (SOA) (Latest one month) with a minimum loan/limit/line of Php25,000

- Other loan statements with a min. loan limit Php 15,000

Self-employed requirements:

- Valid ID (for identity identificati0n), AND

- ANY of the following:

- Credit Card Statement of Account (SOA) (Latest one Month) with a minimum loan/limit/line of Php25,000

- Other loan statements with a min. loan limit of Php 15,000

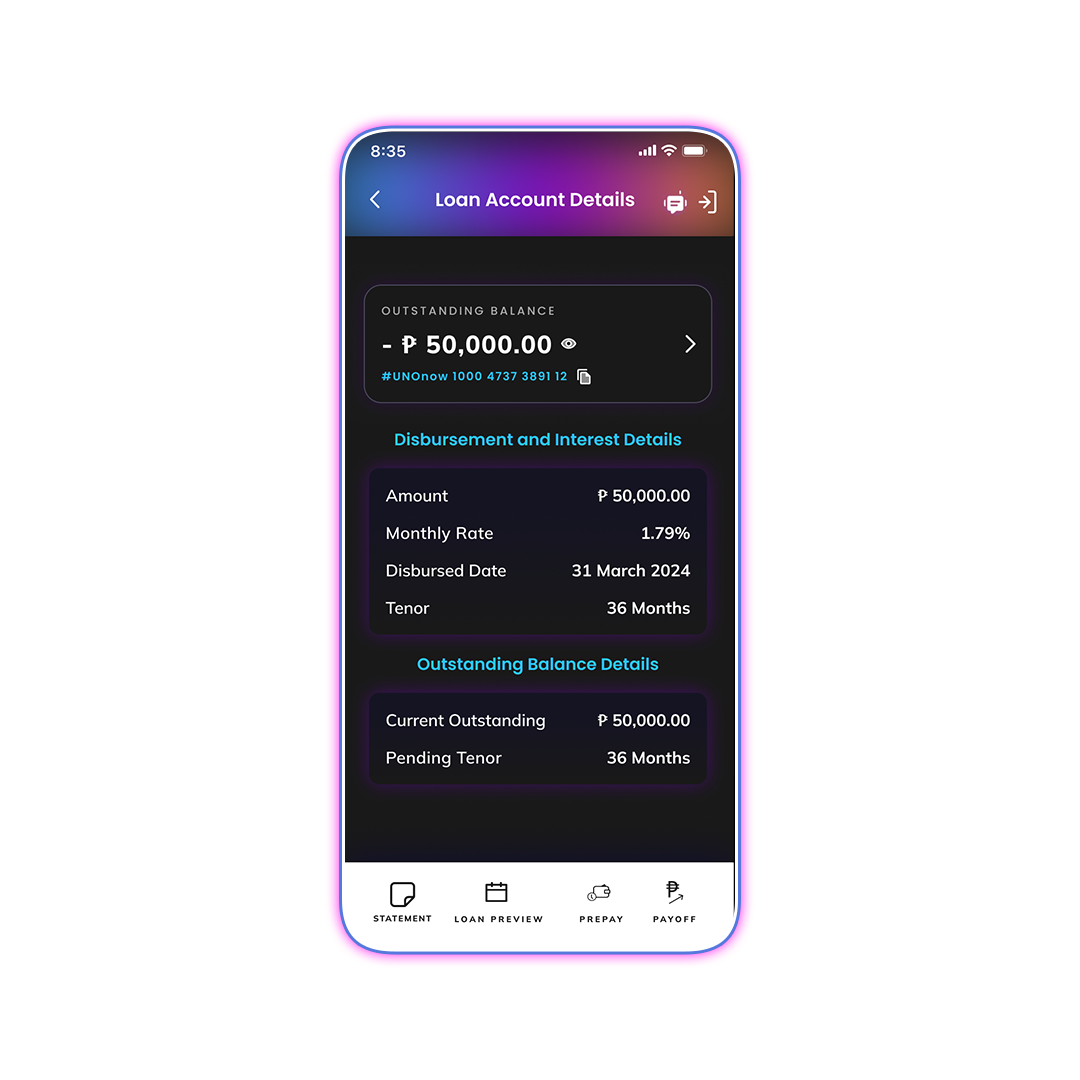

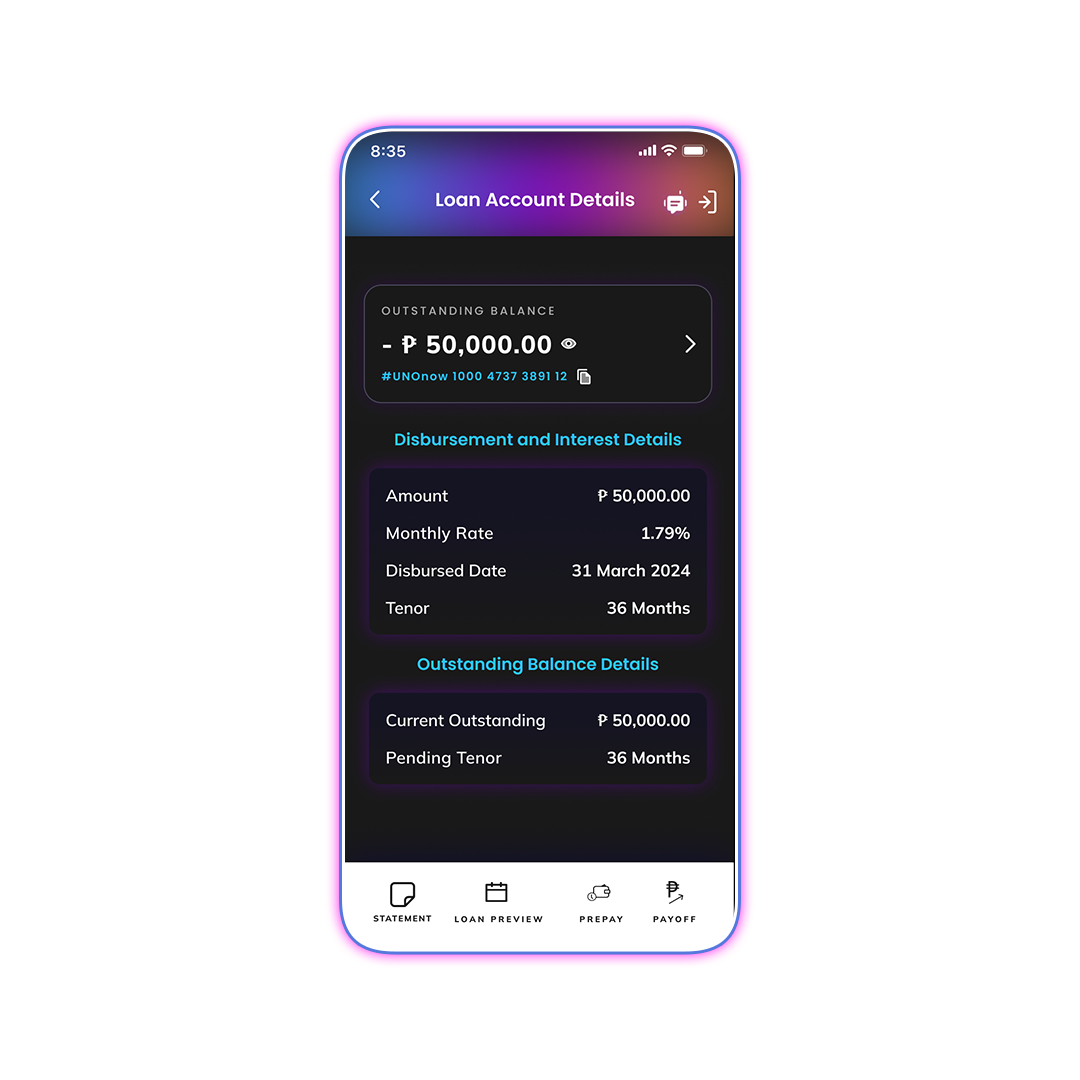

UNO offers loans between PHP 15,000 to PHP 250,000 with repayment tenors ranging from 6 to 36 months.

You can get as low as a monthly add on rate of 1.79% (Corresponds to annual contractual rates or annual percentage rates ranging from 35.78% to 37.54%, depending on the loan tenor).

| Tenor | Monthly Rate | APR (P.A) | EIR (P.A)* |

|---|---|---|---|

| 6 | 1.79% | 35.94% | 57.22% |

| 12 | 37.54% | 52.87% | |

| 18 | 37.45% | 50.32% | |

| 24 | 36.98% | 48.38% | |

| 36 | 35.78% | 45.42% |

- Processing Fee – 3% of the loan amount or PHP 500 whichever is higher, to be deducted from the loan proceeds

- Documentary Stamp Tax (DST) – PHP 1.50 for every PHP 200.00, or fractional part thereof, of the loan amount, and shall also be deducted from loan proceeds prior to release, when applicable.

- Late Payment Fee – 5% of unpaid installment or PHP 500 whichever is higher

- Loan Pre-termination Processing Fee – 3% of unbilled amount or PHP 300 whichever is higher (applicable on loans > 30 days; none on loans < 30 days)

Application processing is straight-through which means that you get the result of the credit evaluation fast. However, should there be a need for other documents and further checks, you can see the status when you enter the UNO Mobile App or you will be notified via SMS.

It is the amount that must be paid on the Due Date based on the Amortization/Payment Schedule provided to you. For the first payment due date, charging of the principal is deferred, so the Amount Due shall only be the Initial Interest or interest accrued from the time the loan proceeds are disbursed until the first due date. This Initial Interest will be collected from you due to the longer period to repay the principal. In case of past due, the Amount Due may consist of all unpaid monthly installments, late payment fees and other applicable charges.

UNO conducts reprocessing and reconsideration of previously declined applications. Hence, there is no need to be surprised if you received a message that your application is declined and you still got visited by a credit verifier.

You may reapply after 3 months.

- For new-to-bank customers – you need to click JOIN UNO, enter your mobile number and OTP, accept the offer and follow the instructions in the app.

- For existing-to-bank customers – go to the Loans Tab, click the Apply Now button, accept the offer and follow the instructions in the app.

There could be instances when the Loan Acceptance screen and button are not working, or you are not able to see the offer in the Loans Tab. Should this happen, please get in touch with our Customer Happiness Team via in-app messaging inbox or live chat through the UNO Mobile App or call Customer Happiness hotline at (02) 8811 8866 or +63 919 0599866 so we can facilitate the disbursement of your loan through other means like manual booking. Likewise, UNO can initiate manual booking if the error is affecting multiple customers.

It is important that you already opened an UNO savings account for manual booking to happen.

You will receive a DocuSign link via your registered email. When clicked, the link will take you to a digital copy of your loan agreement. You need to digitally sign the document and click Finish to complete the signing process. Once completed, the document will go back to UNO and the bank can proceed with the manual crediting of your loan proceeds to your savings account within 3-5 banking days.

There is no need to download and print/send the document back to UNO. When you click Finish after signing the document, the loan agreement will automatically go back to UNO.

You may call our Customer Happiness Team to inform us that payment is not yet debited. You may also just keep the payment intact as UNO will retry to debit your account for the monthly payment of your loan.

A late payment fee of PHP 500 OR 5% of unpaid installment, whichever is higher, will be applied to each monthly installment that will not be fully settled upon due date.

You can transfer funds to your #UNOready savings account via QRPH scan, InstaPay, or PESOnet from your other e-wallets or bank accounts . Your ADA will be automatically activated and your existing balance will be used to pay off your current monthly amortization.

Yes, you may fully repay your total loan outstanding and you can do so by first contacting UNO’s Customer Happiness Team via the in-app messaging inbox or live chat feature in the UNO Digital Bank Mobile App or call Customer Happiness hotline at (02) 8811 8866 or +63 919 0599866. We’re here daily from 6AM to 10 PM for all inquiries, and our fraud hotline is 24/7 for urgent concerns. Please note that a Pre-termination Processing Fee will be charged as follows: 3% of unbilled amount or minimum PHP 300 whichever is higher.

Your due date will be on the 1st on the immediately succeeding month from the time that your loan proceeds were disbursed.

For example: If your loan was disbursed on April 5, your first due date will be on May 1 and due date will be every first of the month thereafter.

If the Loan Details screen is not visible, you can always refer to your amortization schedule for the payment amount and payment due date. Likewise, you will receive a payment reminder informing you of these details.

- Loan Agreement / Terms and Conditions

- Promissory Note

- Disclosure Statement

- Loan Amortization Schedule

The file is password-protected, and you need to enter the default password. Please follow the email instructions to open the document.

One app for all!

Do everything in just a few taps. From applying for an online bank loan in the Philippines to transferring money into your savings, all your banking needs can be managed through the UNO Digital Bank app. Elevate your banking experience and get started today!