Frequently Asked Questions

For any concern or if you’re just curious, feel free to ask away! If your question is not here, you may contact us by sending us an In-app Message or via our Live Chat in the UNO app.

- UNO Digital Bank and UNO Mobile App

- Registration

- Login and Logout

- Accounts

- Add Money (Deposit, Cash in)

- Send Money, Get Cash (Cash-out/Over-the-Counter Withdrawal)

- Scan QR

- Pay Bills

- Account Closure

- Raise a Concern

- Debit Card

- Appification

- #UNOready@GCash

- Insure

- Credit Armor

- #UNOeasy

- Collections

- UNO Coins Missions

- UNO Referral Promo

- Top Up Loans

- #UNOnow via Atome

UNO Digital Bank (“UNO”) is one of the the first neobanks to get an outright digital banking license in the Philippines. UNO is supervised by the Bangko Sentral ng Pilipinas (BSP) and has its deposits insured by the Philippine Deposit Insurance Corp (PDIC).

Through the UNO Mobile App, you have easy access to our banking products and services. As a full spectrum digital bank, all our processes are done digitally, end-to-end, which makes delivery of services unconstrained by physical branches.

You may download the UNO Mobile App from either the Apple App Store or the Google Play Store.

For iPhone users, the minimum supported software system is iOS 13.00. For Android users, the minimum supported OS is Android OS 7.00

A front-facing camera is essential for your phone to have. In addition, it is recommended that you have at least 3GB of RAM on your phone.

To successfully function, the UNO Mobile App requires access to your location, contacts list, camera, and photos.

For security reasons, your location and camera are used. Fund transfer recipients are chosen from your contacts list. Your camera and images are used to personalize your account.

Anyone who meets the following qualifications can register:

– Resident citizen of the Philippines

– At least 18 years old

– With a present and/or permanent address in the Philippines

– With at least one (1) valid government-issued identification document (ID)

– With a valid email address

– With a valid local Philippine mobile number

– Is not subject to Foreign Account Tax Compliance Act

To register, simply:

– Download and install the UNO Mobile App.

– Have your valid ID ready.

– Register by going through the onboarding process

To ensure that the documents / IDs you submit are acceptable:

– Do not use a camera flash to avoid taking a bright photo.

– Do not cover any part of your document / ID.

– Make sure the whole document / ID is within the frame.

Please contact the UNO Customer Happiness Team via chat, in-app message, or via phone at +632 8811 8866 or +63 919 0599866 for registration assistance.

The law requires that banks like UNO conduct due diligence prior to starting a relationship with a new customer. This is to ensure that banks are not used as instruments for money laundering activities. Your face is key to validating your identity and account ownership through the Selfie Check (facial recognition security feature that also confirms liveness). As such, please ensure the following:

– Before taking a selfie, remove your glasses and / or hat and avoid excessive backlighting.

– To capture your selfie automatically, frame your face inside the oval and position your device at eye level while looking directly at the camera.

– Verify that your eyes are open.

– Confirm that you are satisfied with the capture. Otherwise, you may choose to retake.

It is because you have not granted permission for the UNO Mobile App to use your phone’s camera. You can go to your phone settings to grant camera permission to the UNO Mobile App.

For your own protection, UNO can invalidate your Password or lock your account or UNO Mobile App without prior notice:

– if your Password does not comply with the security requirements of UNO

– if the wrong Password is entered for 3 times

– if you report that you suspect any unauthorized use of your account or the UNO Mobile App; or

– if you do not comply with the due diligence requirements, or pass screening requirements of UNO.

You may reset your password and passcode. However, you will be required to set up a new password and perform a Selfie Check.

You may upload a photo in the User Profile portion of the UNO Mobile App. Remember that the photo you upload will be visible to other UNO Mobile App users and customers, especially when you perform transactions that involve them such as Send Money.

Follow these steps to reset your passcode:

-Go to your UNO Mobile App’s Menu, lower right part of the dashboard.

-Choose Settings

-Tap on Reset Passcode

-Enter your OTP to authenticate

-Nominate a new passcode!

Reminder when nominating a new passcode:

Must be 4 numerical numbers

Must not be a number pattern such as all repeating (e.g. 1111) or all-sequential (eg. 1234)

You may reset your password. However, you will be required to set up a new password and perform a Selfie Check.

Here are the easy steps:

-Tap on Forgot Password from the login page.

-Enter your registered mobile number and authenticate via OTP and Selfie Scan.

-Nominate a new password. Always follow the instructions on how to nominate a strong password.

Reminder when nominating a new password:

At least 8 Characters in length

Must have at least 1 special character (!@#%&)

Must have at least 1 uppercase character

Must have at least 1 lowercase character

Must have at least 1 number

You can now change your mobile number directly in the app, whether you’re logged in or not.

If you’re not logged in:

- Open the UNO Digital Bank app

- Tap More on the bottom right

- Tap Change Mobile Number

- Enter your current registered number

- Enter the OTP sent to your registered email

- Enter your new number and confirm

- Enter the OTP sent to your new number

- Scan your face for identity validation

If you’re already logged in:

- Tap Menu → Settings → Profile

- Tap the ✏️ next to your mobile number

- Enter and confirm your new mobile number

- Enter the OTP sent to your new number

- Scan your face for identity validation

Important Reminders:

- Changes to your number may cancel any active loan applications or offers.

- Booked loans will not be affected.

- For any other account details like your address, please contact Customer Happiness.

Make sure your app is updated to the latest version to use this feature.

You can login to your UNO Mobile App via: – Password – Fingerprint verification / Touch ID (Android phones) – Facial recognition / Face ID (iOS phones) Touch ID and Face ID can be enabled once registration is successfully completed. |

You can login using your password in the meantime. After resetting Touch ID / Face ID on your device, reinstall the UNO Mobile App to try again.

Please note that you will once again need to set a new password and passcode, and perform face identity liveness check for security purposes.

You will be logged out automatically when your application has been idle for 4:30 minutes (4 minutes and 30 seconds). If you want to log out completely from the UNO Mobile App, you may also tap the logout icon.

Yes, you can. However, you may only access the UNO Mobile App and your UNO Account from 1 device at any given time.

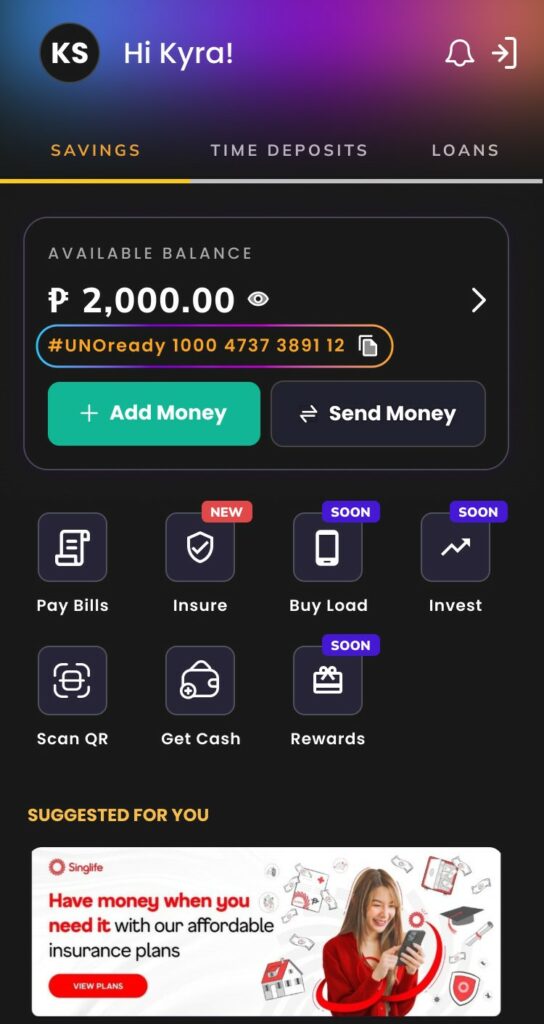

Upon successful login, you will be directed to the Dashboard. This is the main screen of the UNO Mobile App which gives you an overview of your accounts. It also houses the important features and functionalities you may use in doing your day-to-day transactions.

You can find your #UNOready account number as soon as you log in to the UNO Mobile App.

You can receive money, send money, pay bills, and open time deposits. You may also pay for online purchases using your virtual card.

Opening an #UNOready Account doesn’t come with a fee. However, there are certain transactions that have charges. Tap here to view the full table of fees and charges.

| Funds Transfer | Channel | Fee |

| UNO Digital Bank | Intrabank | FREE |

| Other Banks | InstaPay | PHP 8.00 |

| PESONet | FREE |

Yes. Deposits are insured by PDIC for up to Php1,000,000 per depositor. This means that your combined balance in all your accounts is insured up to Php1,000,000.

A Time Deposit is a form of savings-investment in which you keep a certain amount of money for a fixed period of time in exchange for high interest. You can only maximize your interest if you do not withdraw the funds from your term deposit account unless it has reached maturity.

Tap here to view the latest Time Deposit interest rates.

The available Time Deposit products are as follows:

– #UNOboost, a High-Rate Time Deposit which pays out interest earnings upon maturity

– #UNOearn, an Income Time Deposit which pays out interest earnings on a monthly basis

Simply login to your UNO Mobile App. From your dashboard, tap the My Accounts > Add Account > Add Time Deposit. Input your investment amount, desired investment period and done!

Your UNO Time Deposit Account will get funds from your #UNOready Account, so make sure it has sufficient balance.

You have 2 sets of term options to choose from depending on the time deposit product that you choose:

– #UNOboost – any term between 3 to 12 months

– #UNOearn – 12 and 24 months

Yes, you need to open a new Time Deposit account every time your existing Time Deposit account matures.

However, if you plan to reinvest your funds, there’s no need to start from scratch. You can simply choose to roll over your Time Deposit and keep your savings growing.

You can put any amount between Php5,000 to Php500,000 per Time Deposit account, and you may open up to five (5) Time Deposit accounts.

Ideally, you cannot (must not) withdraw the funds from your time deposit account unless it has reached maturity, to maximize interest earnings. If you really need the funds, early withdrawal of the Time Deposit prior to maturity may incur certain charges, including a Documentary Stamp Tax (DST) charge, penalty charge and an adjustment in interest rates.

Early withdrawal of the Time Deposit can only be made for the full amount of the Time Deposit. Partial withdrawals are not allowed.

You may extend the term of your booked Time Deposit (TD) account for the same tenor you initially chose. For example, if you initially chose a 3-month TD and decided to rollover, your TD will start with a term of 3 months and will continue to renew every 3 months until you change the Maturity Instruction back to “Payout”. The rate that you will get for the new term of your TD is the prevailing interest rate on the rollover date.

1. Open the UNO mobile app and go to your Time Deposit Account

2. Under Payout Details, go to Maturity Instruction

3. For #UNOboost, you may set Maturity Instruction to:

- Rollover Principal

- Rollover Principal + Interest

- Payout

4. For #UNOearn, you may set Maturity Instruction to:

- Rollover Principal

- Payout

5. Choose Next to review, then Confirm once final

6. You will see the Successfully Updated page for a successful change in Maturity Instruction

You can change the Maturity Instruction setting anytime from the time you open your Time Deposit (TD) until 2 days before the maturity of the said TD.

You can view your transaction history as far as the last 3 months. If you need to view older transactions, you may refer to your Statement of Account.

With the UNO Mobile App, getting your Statement of Account for savings or time deposit accounts is made easy and quick through these simple steps.

– Launch the UNO Mobile App and login to your account

– Tap “Accounts” on the lower left of the dashboard

– Select the account you wish to get the Statement of Account for

– Tap the Statement icon on the lower part of the screen

– Select the period you wish to cover for your Statement of Account

– Tap on the Share icon (lower part of the dashboard)

You can save a copy of your Statement of Account to your device or send it to your chosen application available on your device.

Getting a copy of your Time Deposit Certificate via your UNO Mobile App anytime and anywhere is easy!

Simply follow these steps:

– Tap “Accounts” on the lower left of the dashboard

– Select the Time Deposit account you wish to get the Statement of Account for

– Tap the TD Certificate icon on the lower part of the screen

– You can save the PDF Statement of Account to your device or send it to your chosen application available on your device.

Add Money In-App and Over-the-Counter is temporarily unavailable as we make way for an upgrade to serve you better.

In the meantime, you can still transfer funds to your #UNOready savings account via QRPH scan, InstaPay, or PESONet from your other e-wallets or bank accounts.

Brankas is one of our partners who connects UNO to other banks / financial institutions to facilitate seamless transfers and payments within their network

You may reach us via In-app Message and Live Chat in the UNO Mobile App or call Customer Happiness hotline at (02) 8811 8866 or +63 919 0599866. We’re here daily from 6AM to 10 PM for all inquiries, and our fraud hotline is 24/7 for urgent concerns.

Banks differ in daily transfer and transaction limits, and you may directly confirm these limits from them. It’s advisable that before doing an Add Money transaction via online banking, you first check the actual available amount you can still transfer.

Contact your bank (source account) if the amount you are transferring is not debited from your account balance. Otherwise, please contact our Customer Happiness via In-app Message and Live Chat in the UNO Mobile App or call Customer Happiness hotline at (02) 8811 8866 or +63 919 0599866. We’re here daily from 6AM to 10 PM for all inquiries, and our fraud hotline is 24/7 for urgent concerns.

1. Go to Send Money (located in the upper half section of the dashboard)> Other UNO Acct (or Other Banks). 2. Select the “From” Account (source). By default, the UNO Mobile App preselects the account if you only have one (1) #UNOready Account. Make sure that the “From” Account has sufficient funds to proceed with the transaction. 3. Indicate the “To” Account (recipient). a. If the recipient is another UNO Account, you can simply key-in the mobile number. b. If the recipient is an account maintained in other banks, select the bank name from the drop down list, enter the account number and account name. To notify the recipient, enter the mobile number or email address. 4. Indicate the amount you wish to send. 5. Select the purpose of the transaction from the drop down list. 6. Tap Continue. Enter the Biometrics/Passcode to complete the transaction. 7. A screen saying Transaction Successful will be displayed. |

1. Go to Send Money (located in the upper half section of the dashboard)> Other UNO Acct (or Other Banks). 2. Select the “From” Account (source). By default, the UNO Mobile App preselects the account if you only have one (1) #UNOready Account. Make sure that the “From” Account has sufficient funds to proceed with the transaction. 3. Indicate the “To” Account (recipient). a. If the recipient is another UNO Account, you can simply key-in the mobile number. b. If the recipient is an account maintained in other banks, select the bank name from the drop down list, enter the account number and account name. To notify the recipient, enter the mobile number or email address. 4. Indicate the amount you wish to send. 5. Select the purpose of the transaction from the drop down list. 6. Tap Continue. Enter the Biometrics/Passcode to complete the transaction. 7. A screen saying Transaction Successful will be displayed. |

You may tap the Save/Share button to keep a record of the transaction confirmation. |

For your convenience, you may predefine the details of your recipient/s, especially those that you will be sending money to regularly. To do this:

- Tap Menu located in the Navigation Bar (Android) / Tab Bar (iOS), bottom section of the screen > Manage My Beneficiaries

- Tap Other UNO Acct (or Other Banks, depending on the recipient)

- Choose Add (+).

- Input the required details. Tap Next.

- Key-in your passcode to confirm.

You can also use the Scan and Pay feature of the UNO Mobile App for quick response (QR) code-enabled fund transfers.

InstaPay: Best for smaller, urgent transfers. Funds are credited in real-time, making it great for on-the-spot payments or emergencies.

PESONet: Ideal for high-value, non-urgent transfers. It processes transactions in batches, usually crediting the recipient within the day if made before 3:45 PM of a banking day. Transactions made later or on non-banking days are processed the next banking day.

Over 90 institutions, including major banks and e-wallets support InstaPay and PESONet. A full list is available on the BSP website.

While you’re inside the Manage My Beneficiaries screen, you can do the following activities:

– Search Beneficiary, to make it easier especially if you have registered various beneficiaries

– Edit Beneficiary Details (Tap on the Beneficiary, then select Edit)

– Delete Beneficiary, for those you don’t foresee doing Send Money transactions in the future (Tap on the Beneficiary, then select Delete)

– Send Money, directly to the beneficiary, without the need to go back to the Dashboard (Tap on the Beneficiary, then select Send Money)

The maximum amount per transaction depends on the selected transfer channel:

– InstaPay: The maximum is up to ₱50,000 per transaction.

– PESONet: The maximum is up to ₱500,000 per transaction.

The maximum amount per day is ₱500,000 across Send Money transactions using InstaPay, PESONet and QRPH.

Please also confirm with the recipient bank on receiving limits to avoid unsuccessful transactions and delays.

You need to report this to our Customer Happiness team immediately. UNO needs to validate the status of the transaction before making any adjustments. Valid refunds are processed as soon as possible, but allow us 2 working days to credit back the funds.

Failed PESONet and InstaPay are usually automatically credited back to your account. If not, please ready your transaction reference number and contact our Customer Happiness via the In-app message and Live Chat in the UNO Mobile App or call our 24/7 hotline at +632 8811 8866 or +63 919 0599866. Manual return of funds will happen within 2 banking days.

Ideally, you cannot (must not) withdraw the funds from your time deposit account unless it has reached maturity, to maximize interest earnings. If you really need the funds, early withdrawal of the Time Deposit prior to maturity may incur certain charges, including a Documentary Stamp Tax (DST) charge, penalty charge and an adjustment in interest rates.

Early withdrawal of the Time Deposit can only be made for the full amount of the Time Deposit. Partial withdrawals are not allowed.

Scan QR is an UNO Mobile App payment facility that enables fund transfer by scanning a quick response (QR) code. This allows you to initiate payments easily and avoid erroneous payments brought about by manual input of payment details.

It can be used in transferring funds to other accounts or making payments at merchant outlets, e-commerce websites, grocery stores and other QR-enabled payment transactions.

Your UNO account has its own QR code which can be used by other UNO customers to Send Money to you. To see your QR code, tap Scan and Pay > Show My QR. You can have your QR code scanned directly from your phone screen, or you can use the Share/Save feature to keep a copy in your gallery/folder.

Pay Bills is a functionality in the UNO Mobile App that allows you to settle telco, electricity, water, internet, cable, credit card and other utilities.

With our Pay Bills feature in the UNO Mobile App, you can settle your telco, electricity, water, internet, cable, other utilities, airlines, credit card, loan and insurance dues anytime! Let me share how:

1. Tap Pay Bills icon from the dashboard

2. Select the Biller Type.

3. Choose the Name of Biller from the Payee Name dropdown list.

4. Enter Account Number and Amount

6. Review and confirm details.

7. Authenticate the transaction via Biometrics or Passcode

Make it easy for you to use the Pay Bills feature without having to re-enter the account details each time you settle your dues. Here’s what to do:

– Launch the UNO Mobile App and login to your account

– Click Menu on the lower right of your app dashboard

– Go to Manage My Payees

– Click “ADD” on the lower right of the screen

– Enter all the required information

Now you can start paying your bills easily with all the biller details saved in the app!

As much as possible, UNO wants to keep customers from leaving. However, should you need to close your account, you may do so by contacting the Customer Happiness team via In-app Message and Live Chat in the UNO Mobile App or call Customer Happiness hotline at (02) 8811 8866 or +63 919 0599866. We’re here daily from 6AM to 10 PM for all inquiries, and our fraud hotline is 24/7 for urgent concerns. Please ensure that you don’t have any outstanding obligations with UNO prior to closure.

UNO may close your account in the following instances:

– If you have not funded your account within the first 3 months from account opening

– If your account becomes an Inactive Account

– If you do not submit the documentary requirements within fifteen (15) days from the date you open your UNO account,

– If you fail to comply with periodic KYC refresh as per applicable laws and regulations.

Likewise, UNO may immediately suspend or close your account at any time in the following situations:

– If it is established that you have misrepresented or falsified information

– If it is established that your account is connected with any fraudulent or illegal activities / transactions

– If you fail to abide by or breach any provision of the Terms and Conditions

– If UNO deems that you have handled your account improperly or unsatisfactorily.

You can get in touch with UNO Digital Bank’s Customer Happiness team anytime through these channels:

1.Live Chat

– Open the UNO Mobile App.

– Tap the chat icon at the top-right of the dashboard to instantly get answers to your questions with our quick and reliable self-help feature, designed to assist you with all things UNO.

2. In-App Messaging

– Open the UNO Mobile App.

– Tap the Messages icon (envelope icon) in the lower-right corner of the screen.

– Press the + Compose button in the middle of the screen.

– Select a subject, type your message, and press Send to get a prompt response.

3. Phone Support

Call us at +63 919 059 9866 or +63 (2) 8811 8866, we’re here daily from 6AM to 10 PM for all inquiries, and our fraud hotline is 24/7 for urgent concerns.

For concern sent through the in-app messaging in the UNO Mobile App, tap on the Messages icon (envelope icon) from your dashboard. The concerns raised and responses of our Customer Happiness Specialists will be available in your Message Inbox.

The UNO Physical Debit Mastercard is your global and in-store access to your UNO Savings Account.

This is an upgrade from your UNO Virtual Debit Card, you can use your card to withdraw cash at ATMs or make in-store purchases locally and globally wherever Mastercard is accepted.

To be eligible, the applicant must have:

• An active #UNOready savings deposit account (“Account”); and

• An active virtual debit card; and

• An available balance of, at least, Three Hundred Pesos (PHP 300.00) to cover for the card issuance fee, or such other amount as may be determined by UNObank from time to time

You can do the following transactions using your UNO Debit MasterCard:

• Withdraw cash from ATMs that accept MasterCard.

• Make in-store purchases using a POS terminal.

Wherever Mastercard is accepted, your UNO Physical Debit Mastercard is ready for you!

To activate your card using the UNO Digital Bank app, please follow these steps:

1. Navigate to the My Card section.

2. Select the Banner prompt.

3. Tap on Activate Card.

4. Read and accept the Declaration.

5. Complete the required Authentication process.

6. Upon successful verification, your card will be activated.

Tip: Activation must be done only after you physically receive your card.

Yes, a one-time card issuance fee of PHP300 will be charged upon request for your card.

Your card will be delivered to the address you provided during your application. Make sure your delivery details are accurate to avoid any delays!

If your Debit Card is damaged or contains incorrect name upon delivery, please contact our Customer Happiness via In-app Message and Live Chat in the UNO Mobile App or call Customer Happiness hotline at (02) 8811 8866 or +63 919 0599866. We’re here daily from 6AM to 10 PM for all inquiries, and our fraud hotline is 24/7 for urgent concerns.

Absolutely. Your card is numberless for enhanced security, all your sensitive details (card number, expiry, CVV) are securely stored inside your UNO app.

To reset your card PIN, please follow these steps:

1. Navigate to the My Card section.

2. Select Manage Card.

3. Tap on Reset PIN.

4. Enter and confirm a new 6-digit PIN of your choice.

5. Complete the required Authentication process.

6. A confirmation message will indicate successful PIN reset.

Act quickly to ensure your safety. Lock your card using the UNO app and follow these steps:

1. Navigate to My Card.

2. Tap Replace Card.

3. Select Lost, Stolen, or Compromised Card.

4. Choose Block Card and tap Continue to proceed.

5. Authenticate the transaction using biometrics or a passcode.

6. Confirmation will appear once the card has been successfully blocked.

7. Tap Replace Card to initiate a new card request.

8. Complete the Request Debit Card form with accurate replacement details.

9. Carefully review details, then tap Submit Details.

10. Authenticate the request to finalize the process.

11. A confirmation message will indicate successful processing.

12. The new physical debit card will be delivered within 7–15 banking days.

Otherwise, please contact our Customer Happiness via the UNO In-App Message or call our 24/7

hotline at +632 8811 8866 or +63 919 0599866.

A replacement card can be requested (replacement fees may apply).

Yes, you can still do the following transactions abroad:

• Withdraw cash from Mastercard ATMs globally.

• Make purchases in-store and online wherever Mastercard is accepted.

• Foreign transactions are subject to Mastercard 2.5% international service fee on the converted amount.

You can set your own spending and withdrawal limits anytime using the UNO Digital Bank app.

| Financial Limit | Min Amount per Transaction | Max Amount per Transaction | Aggregate Daily Limit |

| e-Commerce / Online Transactions | PHP 100.00 | PHP 100,000.00 |

PHP 200,000.00 |

| POS Transactions | PHP 1.00 | PHP 200,000.00 | |

| ATM Withdrawals | PHP 100.00 | PHP 50,000.00 | PHP 50,000.00 |

Transactions will decline if your UNO Savings Account doesn’t have sufficient balance.

• Open your UNO Digital Bank app.

• Go to the Transaction Details screen.

• Tap on the Dispute icon.

You may also contact our Customer Happiness via In-app Message and Live Chat in the UNO Mobile App or call Customer Happiness hotline at (02) 8811 8866 or +63 919 0599866. We’re here daily from 6AM to 10 PM for all inquiries, and our fraud hotline is 24/7 for urgent concerns.

Any dispute must be filed within sixty (60) calendar days from the transaction date. The dispute will be resolved in accordance with applicable Mastercard chargeback/dispute processes and procedures.

Yes! If you return an item and the merchant processes a refund, the amount will be credited back to your #UNOready Account. Standard refund processes and timelines apply.

Lock your card to prevent any unauthorized transactions.

Once that is done, immediately contact the Hotline of the Acquiring ATM and get the Terminal ID which should be visible on the machine. We also recommend visiting the nearest branch of the Acquiring Bank to help address this issue. Acquiring banks have an internal process until they destroy the debit card. Please be sure to contact them immediately when this happens.

If this happens, please report the issue by tapping the Dispute icon within the transaction details in your UNO app. Our support team will review the ATM reconciliation records and, if applicable, process a reversal based on standard procedures.

You may also contact our Customer Happiness via UNO In-app message or call our hotline at +632 8811 8866 or +63 919 0599866.

Any dispute must be filed within sixty (60) calendar days from the transaction date. The dispute will be resolved in accordance with applicable Mastercard chargeback/dispute processes and procedures.

If you see a duplicate charge, tap Dispute within the transaction details to report it. Retaining the original receipt or proof of transaction is recommended, as it may help facilitate a quicker resolution.

You may also contact our Customer Happiness via in-app Message and Live Chat in the UNO Mobile App or call Customer Happiness hotline at (02) 8811 8866 or +63 919 0599866. We’re here daily from 6AM to 10 PM for all inquiries, and our fraud hotline is 24/7 for urgent concerns.

In just a few taps:

1. Navigate to My Card.

2. Tap on Lock My Card to lock the card.

3. To unlock, tap Lock My Card again.

Always remember:

• Sign the back of your card as soon as you receive it.

• Keep it in a safe place.

• Never share your PIN or card details.

• Regularly update your PIN using the UNO app.

When this happens, please contact our Customer Happiness via in-app Message and Live Chat in the UNO Mobile App or call Customer Happiness hotline at (02) 8811 8866 or +63 919 0599866. We’re here daily from 6AM to 10 PM for all inquiries, and our fraud hotline is 24/7 for urgent concerns.

The UNO Virtual Debit Mastercard is your global access to your #UNOready Account. You may use your card to pay for online retail purchases locally and globally, wherever Mastercard is accepted.

You may use it for making online purchases locally and globally, wherever Mastercard is accepted.

No, you may only use your virtual debit card for online purchases, wherever Mastercard is accepted.

It’s totally FREE!

The UNO Virtual Debit Mastercard is FREE with every #UNOready Account with a deposit of at least PHP100.

For local online retail purchase transactions, you will not be charged any fees. For foreign online retail purchase transactions, 2.5% will be charged on the peso conversion as International Transaction Fee representing the Bank’s service fee and any assessment fee(s) charged by Mastercard.

For subsequent issuance of a virtual card to the same account, you may be charged PHP50 as Virtual Debit Card Replacement Service Fee.

The aggregate daily limit available on your UNO Virtual Debit Mastercard is PHP 200,000.00. You may, however, control and set your own daily transaction limit using the UNO Digital Bank app

Your UNO Digital Bank app makes it easy!

All transactions made using the UNO Virtual Debit Mastercard will be deducted from your #UNOready Account balance.

Your retail purchase will be declined.

Not to worry, UNO is here for you.

If you have any disputes regarding your transactions, you may follow these steps:

1. Open your UNO Digital Bank app

2. Go to the Transaction Details screen

3. Tap on the Dispute icon

Any disputed card transaction will be investigated by UNObank, which may entail further verification of transaction records and confirmation with you and/or the network or merchant. Any dispute must be filed within sixty (60) calendar days from the transaction date.

The dispute will be resolved in accordance with applicable Mastercard chargeback/dispute processes and procedures.

You may also reach out to Customer Happiness via in-app Message and Live Chat in the UNO Mobile App or call Customer Happiness hotline at (02) 8811 8866 or +63 919 0599866. We’re here daily from 6AM to 10 PM for all inquiries, and our fraud hotline is 24/7 for urgent concerns.

Yes, refunds are possible!

The refunded amount will be credited back to your #UNOready Account. The merchant will be the one to initiate the process of refund and settle the amount with UNO, subject to the merchant’s return policy. Standard refund processes and timelines will apply.

You can choose to lock your card temporarily in the UNO Digital Bank app. Simply tap the MY CARD icon located at the bottom of the dashboard and swipe right to lock your card. Once your card is locked, you will not be able to use it for any transactions. You can unlock the card in the app to use it again.

If you see an unknown or suspicious transaction done using your card in your transaction history, lock your card in the MY CARD section in the UNO Digital Bank app and report the transaction immediately. Contact our Customer Happiness via in-app Message and Live Chat in the UNO Mobile App or call Customer Happiness hotline at (02) 8811 8866 or +63 919 0599866. We’re here daily from 6AM to 10 PM for all inquiries, and our fraud hotline is 24/7 for urgent concerns.

For simple cases, turn-around-time is 7 banking days. For cases that need to be referred to Mastercard, turn-around time may take up to 45 calendar days. However, for transactions that need further investigation, more time may be needed.

Yes, you can raise several disputes for different transactions at the same time. Here are the steps:

1. Locate and tap the transaction from your dashboard’s Recent Transactions view.

2. Tap on the Dispute icon

You can also send us a message via your In-App messaging inbox (envelope icon) at the lower right of your UNO Mobile App Dashboard.

This is on a case-to-case basis. You will be notified via call/email should there be a need for you to submit documents.

Yes, you will be notified via in-App messaging inbox once the dispute is resolved. You will receive a final disposition letter regarding the resolution of your dispute. Also, any credit adjustment will be posted on your account for successful dispute/s.

No. Disposition of invalid disputes are considered final.

Virtual debit card is available when you link your GSave account to UNO Mobile App.

We are sorry for this inconvenience. Please contact our Customer Happiness via in-app Message and Live Chat in the UNO Mobile App or call Customer Happiness hotline at (02) 8811 8866 or +63 919 0599866. We’re here daily from 6AM to 10 PM for all inquiries, and our fraud hotline is 24/7 for urgent concerns.

We are sorry that you are leaving. Before closing your account, ensure that you take out all your money by transferring it to your GCash account or another bank.

To close your account, please contact Customer Happiness via In-app Message and Live Chat in the UNO Mobile App or call Customer Happiness hotline at (02) 8811 8866 or +63 919 0599866. We’re here daily from 6AM to 10 PM for all inquiries, and our fraud hotline is 24/7 for urgent concerns.

You may withdraw your money through the GCash app by tapping “Withdraw Money” from your #UNOready@GCash account. Funds will be credited to your GCash Wallet.

1. Through GCash App

We’re sorry that you are leaving. Before closing your account, ensure that you take out all your money by transferring it to your GCash account or to another bank. To close your account, please contact our Customer Happiness at +632 8811-8866 or +63 919 0599866 during our business hours of 6am to 10pm – Mondays to Sundays or send us a message via the UNO In-App Message.

You may find the insurance products by clicking the “Insure” button when you log in to the UNO Mobile App.

| Product | Cash for Income Loss (Accidents Only) | Cash for Medical Costs | 3-in-1 Protection Plan | Cash for Goals |

| Description | Replace of income lost caused by disablement or death due to accidents. | Cash to cover medical costs due to hospitalization, critical conditions, and surgery. | Cash to cover medical costs due to Dengue, COVID-19, and Accidents. | Life insurance and investment product rolled into one. |

Starting Price/month | Php120 | Php224 | Php79 | Php2,000 |

You can learn more about these products when you click the “Insure” button in the UNO Mobile App.

Your monthly premiums will be deducted to your #UNOready account every 30 days. Make sure that your account is funded to continue your protection.

1. Log in to the UNO Mobile App

2. Click on the “Insure” Tab

3. Once you are in the Singlife Microsite, click on “Manage”

4. Access the policy you want to cancel

5. Go to “Services”

6. Click on “Cancel Policy”

We’d love to keep you protected again! Simply reactivate your policy on the UNO Mobile App by simply logging in and clicking the “Insure” button. Look for the Singlife policy card and click the “Services” tab for reactivation.

Simply send an e-mail to help@singlife.com and they will respond within 24 business hours with the list of requirements to be submitted.

1. Log in to the UNO Mobile App

2. Click on the “Insure” Tab

3. Once you are in the Singlife Microsite, click on “Manage”

4. Access the policy you want to cancel

5. Go to “Services”

Credit Group Life Insurance is a group insurance offered by Sun Life Grepa Financial, Inc. (“SLGFI”), that covers the Outstanding Balance of customer’s #UNOnow Loan account in the event of death. It is also known as Credit Insurance or Credit Armor.

In the event that the insured #UNOnow Loan customer passes away, SLGFI will settle all of the customer’s outstanding balance in his/her #UNOnow Loan Account to UNO. If the Credit Group Life Insurance coverage exceeds the outstanding balance, the excess amount will be paid out to the insured customer’s beneficiary(ies).

For a borrower to be able to avail of a Credit Group Life Insurance, he/she must be:

1. Between 18-65 years old

2. A Filipino citizen

3. In good health; have no physical or medical impairment; and performing the daily normal activities of his/her life

Availment of the Credit Group Life Insurance is via the UNO Mobile App, during loan disbursement. This is via opt-in basis and customer needs to tick the box saying that he/she wants to avail of a Credit Armor.

Fee payment will be deducted from the loan proceeds upon disbursement of the loan, and is equivalent to 4% of the loan amount.

Coverage is during the life of the loan. It will automatically end when the loan matures or gets fully paid.

A Proof of Cover will be sent to your registered email address from UNO’s insurance partner, SLGI. This will serve as the confirmation of customer’s coverage.

Customer’s legal beneficiary(ies) may file a claim under the Credit Group Life Insurance Policy. Beneficiary to directly coordinate with SLGI and provide death certificate of the borrower and proof of cover. Once validated, SLGI will provide the beneficiary the complete list of claim requirements.

Written notice of claim must be submitted to Sun Life Grepa Financial’s Office within 30 days from date of death. Proof of claim must be submitted not later than 90 days from date of death.

Failure to submit the written notice and proof of claim within the time limits shall not invalidate or reduce any claim if it shall be shown not to have been reasonably possible and was submitted as soon as was reasonably possible. For further inquiries, please contact our SLGI at telephone numbers 8-866-6863 to 64 from Mondays to Fridays, 8:00 a.m. to 5:00 p.m. Customer may also send an email to: SLGFI-Group_Underwriting@sunlifegrepa.com

Excess of the amount of insurance over the outstanding loan balance shall be payable to the first surviving class of the following order of classes of beneficiaries deemed named by the customer:

The deceased borrower’s:

1) widow or widower;

2) surviving legitimate and illegitimate children;

3) surviving parents;

4) surviving brothers and sisters of the full blood;

5) surviving brother and sister of the half blood; or

6) executors, administrators or assigns.

As of the moment, minimum-maximum coverage is at Php10,000-Php500,000.

#UNOeasy is here to make life easier for you! Get up to PHP 150,000

worth of loan to get that appliance, gadget, or furniture you want right

from the tip of your finger! Just visit any of our partner stores to try

#UNOeasy.

You can use #UNOeasy in purchasing different electronics, furniture, or

home appliances, ranging from mobile phones, laptop, television, air

conditioner, and many more!

#UNOeasy is available to applicants who meet ALL the criteria below:

- Individuals

- At least 21 years old; must not be older than 65 years old upon

loan maturity - Filipino national/resident

- Resides and/or works within Metro Manila, Rizal, Laguna,

Batangas, Cavite, Bulacan, Pampanga, Cebu, Iloilo, Davao del

sur, Bacolod, Alaminos City, Dagupan, Cabanatuan, San Jose,

Cagayan de Oro, Lucena, Tarlac, Tacloban, Naga, Subic, Iba,

Olongapo, Legazpi, Dumaguete, Santiago, Cauayan,

Tagbilaran, San Fernando, Puerto Princesa, Tuguegarao, Baguio - Receives a minimum gross monthly income of PHP 25,000

- If employed, must be tenured for at least 6 months

- If self-employed, business must be in operations for at least 2

years

We have selected partner stores for #UNOeasy. Please see our partner stores below:

- MemoXpress

- Rulls

- Vivo

- Anson’s

- Arkhomes

And more stores coming soon!

Applicants must present any of the following primary IDs which showcase both their identity and current address:

- Driver’s License – PREFERRED

- Unified Multi-Purpose ID (UMID) – PREFERRED

- Philsys National ID (Physical card) – PREFERRED

- Postal ID – PREFERRED

You don’t need a bank account or credit card from other banks to apply! You will automatically be provided with an #UNOready Savings account upon onboarding!

For existing customers, your #UNOeasy will be automatically linked to your #UNOready upon approval of application.

Yes! You are required to pay a minimum down payment of 20% of the product price.

UNO offers loans between PHP 10,000 to PHP 150,000 with repayment tenors ranging from 6 to 18 months.

#UNOeasy loan offers a monthly add-on rate as low as 2%. We also now offer 0% interest, available exclusively through select partner merchants!

Application processing is straight-through which means that you get the result of your eligibility for loan on the spot.

Yes. Please expect to receive the following documents through your registered email address after availing loan:

- Promissory Note

- Disclosure Statement

- Amortization Schedule

Please note that we currently do not support multiple item purchases or item bundling in a single transaction, but we are working on it! You’ll be the first to know when you’ll be able to purchase as many consumer durable items as your approved credit line allows.

You’ll soon be able to apply for a reloan and use your remaining balance to purchase another item. For now, this isn’t available just yet but don’t worry—we’ll let you know as soon as this feature is up and running!

As long as you already have an approved credit line, you can come back for and purchase your desired item any time.

You will no longer have to repeat the whole onboarding process—instead, you will be redirected to the purchase flow.

Your installment due date is determined by the date of your product purchase:

- Loans disbursed between the 1st and 15th of the month – your first payment will be due on the 1st of the next month

- Loans disbursed between the 16th and 31st of the month – your first payment will be due on the 1st of the second month after disbursement

If for example, your loan is disbursed on the 20th of August, your first installment will be due on 1st of October.

Your monthly installments will be paid via automatic debit arrangement (ADA) from your #UNOready Savings Account. All you need to do is ensure sufficient funding of the #UNOready on or before your due date for UNO to effect the payment.

If the auto debit arrangement (ADA) is successful, your payment will be reflected the next day

You can fund your #UNOready via Add Money option in the UNO mobile application.

Your ADA will be automatically activated, and your existing balance will be used to pay off your current monthly installment

Yes, you will be allowed to request for either a partial early repayment or “Prepay” or a full early repayment or “Payoff”.

You may access these options via your UNO Mobile Application’s Loan dashboard.

As of the moment, there are no rebates or rewards scheme for early payment.

But rest assured that this will have a good impact on your profile, making you eligible for a possible increase in your available credit limit.

Your first month includes both of your due amount and processing fee. Ensure your #UNOready account has enough balance to cover the total due.

Below are the fees applicable to #UNOeasy:

a. Processing Fee – 3% of the loan amount or PHP 500, whichever is higher

b. Late Payment Fee – 5% of each unpaid monthly installments or PHP 500, whichever is higher

c. Loan Pre-termination Processing Fee – 3% of the loan amount or PHP 300, whichever is higher

Unfortunately, no. The program will follow the refund and/or return policy of the partner store, hence dispute must be coordinated directly with the store from where you purchased the product, not later than your first installment due.

Additionally, your loan will still follow the term and repayment based on your signed loan agreement.

No. Currently, customers are allowed to maintain only one active loan account at a time—either an #UNOeasy loan or a #UNOnow (personal loan). If you have an active #UNOnow loan, you are not eligible to apply for an #UNOeasy loan, and vice versa. We also currently do not allow reloans for #UNOeasy.

Yes! You will be allowed to re-apply for a loan again 90 days subsequent to your previous application.

We encourage using your #UNOready savings account for a higher chance of approval.

You don’t need to line up or worry about missing a payment. Your monthly installment is automatically deducted from your #UNOready Savings Account. Just keep your account funded on or before your due date, and the payment will be processed for you.

Right now, Add Money in-app and over-the-counter is on pause while we upgrade the experience for you.

In the meantime, you can still add funds easily by sending money from your other e-wallets or bank accounts through QRPH scan, InstaPay, or PESONet straight to your #UNOready Savings Account.

You can view all your loan details right inside the app. Here’s how:

- Open your Loan Dashboard and tap on your Loan Account.

- Select the Loan Preview icon at the bottom.

- From there, you’ll see your monthly installment, remaining balance, due dates, and number of months left to pay.

If the Loan Details screen isn’t showing, you can always check your amortization schedule. Plus, we’ll send you payment reminders, so you never miss an update.

You can easily get your Loan Statement right in the UNO Mobile App—no need to call or email. Just follow these steps:

- Open your Loans Dashboard and tap the Statement icon at the bottom.

- Tap the Share icon (lower right).

- Save a copy to your device or send it through any app you prefer.

You can request a Pay Off Statement anytime by reaching out to our Customer Happiness Team. Contact us through our hotline at (02) 8811 8866 or

+63 919 0599866. You can also use the in-app messaging/live chat for quick assistance.

If your loan is past due, our Collections Team can help you explore your repayment options. Just call us at (02) 8811 8866 or +63 919 0599866 (choose local 2) or email us at collections@uno.bank, and we’ll guide you through the next steps.

Yes. UNO Digital Bank may send authorized collections agents for house or office visits.

Our partner collections agents will always:

- Present an agency-issued ID that shows their name and the agency’s contact details (not a UNO Digital Bank ID).

- Never ask you to pay in cash or through any other method. Payments are only done by funding your #UNOready account.

For your safety, if you encounter someone claiming to be an agent but not following these guidelines, please report it right away to our Customer Happiness Team at (02) 8811 8866, +63 919 0599866, or via in-app messaging/live chat.

We send automated reminders—both SMS and calls—to help you stay on track with your payments. These go out to all loan accounts with an upcoming due date, so you have enough time to make sure your #UNOready account is funded.

Yes, you can explore options to update or settle your loan. Just give us a call at (02) 8811 8866 or +63 919 0599866 (press #2) or email us at collections@uno.bank, and our team will guide you through the available arrangements.

The Promo is a limited-time rewards campaign where eligible UNO Digital Bank users can earn UNO Coins for completing qualified transactions during the Promo Period.

The Promo runs from September 12, 2025 and is now extended until December 31, 2025.

Only transactions completed within this period will be eligible for UNO Coin rewards.

The Promo is open to all fully verified UNO account holders with an active #UNOready account.

Use the UNO app to pay any biller at least PHP 300.00, or send at least PHP 300.00 to other banks via InstaPay, to qualify.

Complete the eligible transactions within the Promo Period. Once your transaction is successfully posted, the 50 UNO Coins will be credited to your UNO account in real time.

You can view your UNO Coins balance in your UNO app. Upon login, tap the Missions button to open the Missions page which contains your UNO Coins balance.

| UNO Coins | Cashback Value |

| 5,000 | PHP 50 |

| 10,000 | PHP 100 |

| 50,000 | PHP 500 |

| 100,000 | PHP 1,000 |

Yes. UNO Coins are valid for 2 years from the date they are credited. Expired Coins cannot be reinstated. UNO Coins are consumed on a First-In-First-Out basis. For example, if you earn 100 UNO Coins today, 1,000 UNO Coins in the next month, and consume only 70 UNO Coins, 30 UNO Coins will expire 2 years from today. If you instead consume 200 UNO Coins, no UNO Coins will expire 2 years from today.

Yes. Cashback vouchers are valid for 1 year from the date they are credited. Expired Cashback vouchers cannot be reinstated so redeem them right away.

No. UNO Coins are non-transferable and cannot be converted to cash directly. They can only be used converted to cashback vouchers available within the UNO app.

If your eligible transaction was completed but you did not receive the expected UNO Coins, please contact our Customer Happiness Specialists via:

📲 UNO app in-app messaging or live chat

📞 +632 8811 8866

📱 +63 919 059 9866

🕐 We’re here daily from 6AM to 10 PM for all inquiries, and our fraud hotline is 24/7 for urgent concerns

Yes. UNO reserves the right to reverse or withhold rewards if a participant is found engaging in:

- Fraudulent or abusive behavior

- Creating multiple or fake accounts

- Canceling or refunding eligible transactions

If you close your account or it is flagged, suspended, or deemed inactive, your earned UNO Coins may be forfeited and any pending rewards cancelled.

Unless otherwise specified in the Promo mechanics, there is no maximum cap on UNO Coins you can earn during the campaign. However, rewards are subject to system limitations and fair usage.

You can access the full Terms and Conditions within the UNO app when you visit My Missions and tap on the corresponding mission.

It’s a limited-time referral program where eligible UNO Digital Bank users can earn UNO Coins by referring friends and family to open and use a new #UNOready savings account or #UNOnow personal loan.

The promo runs from October 1, 2025 to December 31, 2025.

Only referrals and qualifying transactions completed within this period will be eligible for rewards.

The Promo is open to all fully verified UNO users with an active #UNOready or #UNOnow account.

Log in to the UNO mobile app and tap the Referral tile from the Dashboard. Share the displayed referral code to your friends and family. Have them click the link and make sure that when they create account, the Referral Code is populated in the Special Code screen. Only referrals made through this feature are considered valid.

You can refer new users who do not yet have an UNO Digital Bank account.

Existing users via GSave are not qualified.

You both earn UNO Coins when your Referee completes the following:

| Referrer Reward | Referee Reward | Qualification |

| 1,000 UNO Coins | 1,000 UNO Coins | Referee deposits at least PHP 500 via PESONet or InstaPay |

Log in to the UNO Mobile App and tap the Missions button. Your UNO Coin balance will be displayed at the top of the page.

Rewards will be credited immediately after your Referral meets the eligibility conditions.

There’s no limit to how many friends you can refer. You will earn rewards for each unique eligible referral.

| UNO Coins | Cashback Value |

| 5,000 | PHP 50 |

| 10,000 | PHP 100 |

| 50,000 | PHP 500 |

| 100,000 | PHP 1,000 |

Yes. UNO Coins are valid for 2 years from the date they are credited and follow a First-In-First-Out (FIFO) policy.

Yes. Cashback vouchers are valid for 1 year from the date they are credited. Expired Cashback vouchers cannot be reinstated so redeem them right away.

No. They are convertible to cash vouchers which you can later redeem to be credited to your UNO Savings Account. Further, UNO Coins are non-transferable.

No. Self-referrals and fake or duplicate accounts are strictly prohibited and will be disqualified. This includes using fake names or misleading others.

UNO reserves the right to reverse rewards or close accounts if fraud or abuse is detected.

If your Referee met all criteria but you haven’t received your UNO Coins, please make sure that your referral has completed a funding requirement first via InstaPay or PesoNet of at least PHP 500.00. If your referral has completed their sign-up with this requirement and still neither of you have received your UNO coins, you may contact Customer Happiness through:

– UNO app in-app messaging or live chat

– (02) 8811 8866 or +63 919 059 9866

– We’re here daily from 6AM to 10 PM for all inquiries, and our fraud hotline is 24/7 for urgent concerns

Yes. UNO may reverse or withhold rewards for violations including fraud, account manipulation, or abuse of the referral system.

Find the complete Terms and Conditions in the UNO Mobile App on the Referral page. Tap the Terms and Conditions button.

This is a New Loan Type wherein existing Customers of UNO may receive an offer to get additional funds disbursed to their accounts along with an updated set of terms and conditions

Currently, Top Up Loans are only offered to Select Customers of UNO, with wider roll-out coming in the near future. Customers eligible for these loans will receive communications regarding their interest in availing these Loans, followed by Email Communications for the new Terms & Conditions

With Top Up Loans, Amounts disbursed to your UNO Accounts are calculated on the Day Itself. Disbursed Amount is calculated by Summing the Outstanding Balance of your Initial Principal Amount & the Accrued Interest Balance which is accumulated Daily causing a change in the final amount disbursed into your accounts.

Your Initial Loan will be superseded by the new Loan Agreement which will be sent to your Emails along with the new Terms & Conditions.

Processing Time will currently be 5-7 Days after your signing of the Loan Agreements sent via Email.

Tap “Apply Now for UNO Loan” in your Atome app, review terms, check your details, and submit your application.

– Rejected: A notification appears in the Atome app.

– Approved: Loan details will be shown in the Atome app.

If you already have an UNO account, you can also check the status in the UNO app under the Loans Tab.

In the Atome app under Loan Acceptance.

Funds are disbursed only in the UNO Mobile app. Atome will notify you, but you must open your UNO app to access the loan.

Yes, you need the UNO app to get the disbursed funds and manage your loan.

No, you can only repay your loan via the UNO app under the Loans Tab.